🚨Big Disclaimer: This is not investment advice. I am not an investment advisor. This information is meant to be for educational purposes. Please do your own research before you decide to invest your hard-earned money. If you are unsure seek help from a professional financial advisor who can understand the full breadth of your financial needs & commitments to advise you on what you should do.

🙅♀️What?? there is more to Crypto than just Bitcoin & Doge!!

Are you really serious!

Elon might have got most people convinced that Bitcoin + Doge = Crypto!! And putting your lives savings into them would lead to bags of money for you💰💰in the future. I can’t say whether that will be true or not. But on a more serious note, most people don’t really understand what are the other crypto currencies out there & what each project does.

In this article, I will provide an overview of the Top 5 cryptocurrencies. This is meant to provide a basic understanding not a detailed guide of each project. Hopefully, if you can read the whole article you would be able to have an intelligent conversation over cocktail dinners (what they are having cocktail dinners during covid – I want to be invited too)

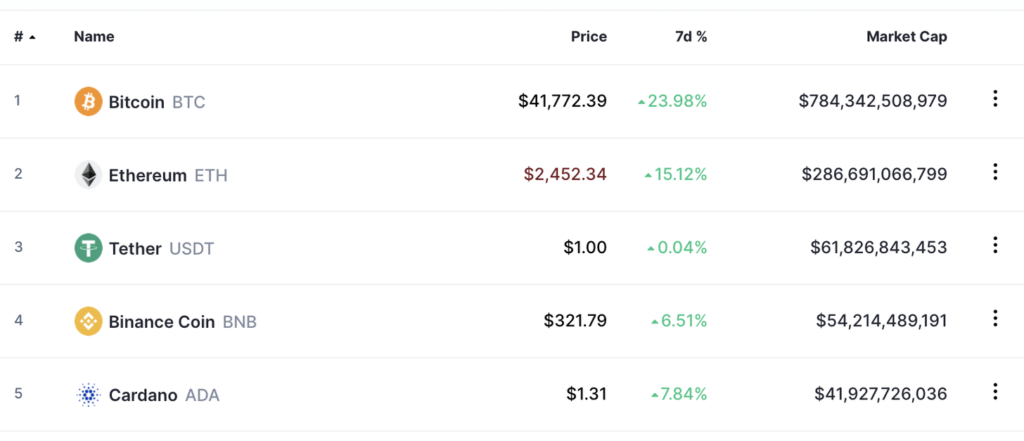

Coinmarketcap.com, currently tracks ~11k tokens across 391 exchanges. They estimate the total size of the Crypto Market to be $1.6Tn

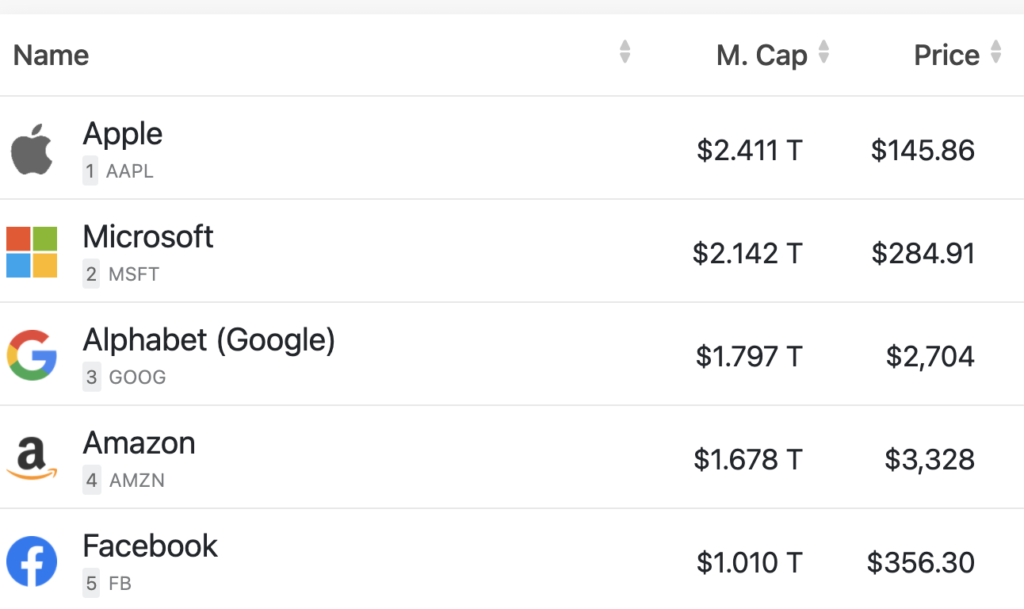

$1.6Tn – Is that a lot or is that less?

Well, the best thing to do is to compare it to something else. As context, the Top 5 technology companies in the US currently have a market cap of $9Tn.

With its current market size, the Crypto market today is only close to the market cap of Amazon or Google individually. This means there is a long way for the crypto projects to create value and get to mainstream valuations once their use cases expand.

The total Crypto Market size is $1.6Tn. Thats about the size of Amazon or Google’s market cap.

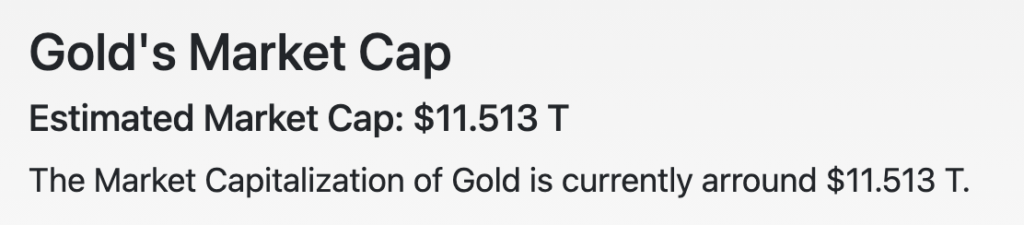

One of the use-cases of Bitcoin is often touted as Digital gold due to its scarce supply (similar to gold), Gold has an estimated market cap of between $9Tn to $12Tn depending on how it is calculated still a lot higher than the ~$800Bn Bitcoin market cap.

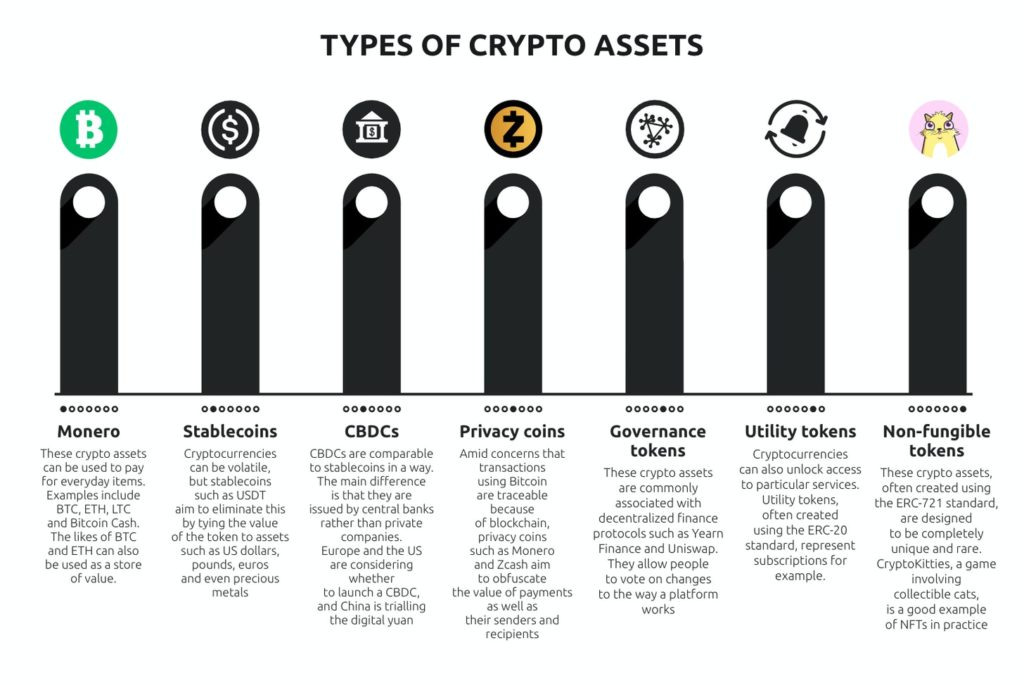

If you are new to crypto, I would encourage you to read my earlier post as it provides context to the different types of tokens & where they get their value from

1. ₿-Bitcoin (BTC) – Mkt Cap $784Bn

First “Trustless digitally scarce” decentralized asset

Created in 2009 by someone under the pseudonym Satoshi Nakamoto, Bitcoin (BTC) is the original cryptocurrency. As with most cryptocurrencies, BTC runs on a blockchain, or a ledger logging transactions distributed across a network of thousands of computers. Because additions to the distributed ledgers must be verified by solving a cryptographic puzzle, a process called proof of work, Bitcoin is kept secure and safe from fraudsters. Some important characteristics of Bitcoin:

- Store of value, Payment system, Digital Gold, Global Settlement Network, P2P Electronic cash

- Permissionless, Borderless, Anonymous, Censorship Resistant, Fast & cheap transfers, verifiable

- Deflationary monetary policy, inflation hedge

- Risks – Volatility, Regulatory bans, Custody

- Increased acceptance by small businesses & institutions

Want to know more about the Bitcoin value read my article on – 💰Bitcoin Price – Scam or Real?

Price Action: Bitcoin’s price has skyrocketed as it’s become a household name. Five years ago, you could buy a Bitcoin for about $500. As of Jul 2021, a single Bitcoin’s price was over $41,700. That’s a growth of about 8,300%.

2. Ethereum (ETH) – Mkt Cap $287Bn

Ethereum = 1(App Store) + 2(AWS Cloud infrastructure) + 3(Blockchain)

Ethereum combines three of the most disruptive ideas of our time into one solution

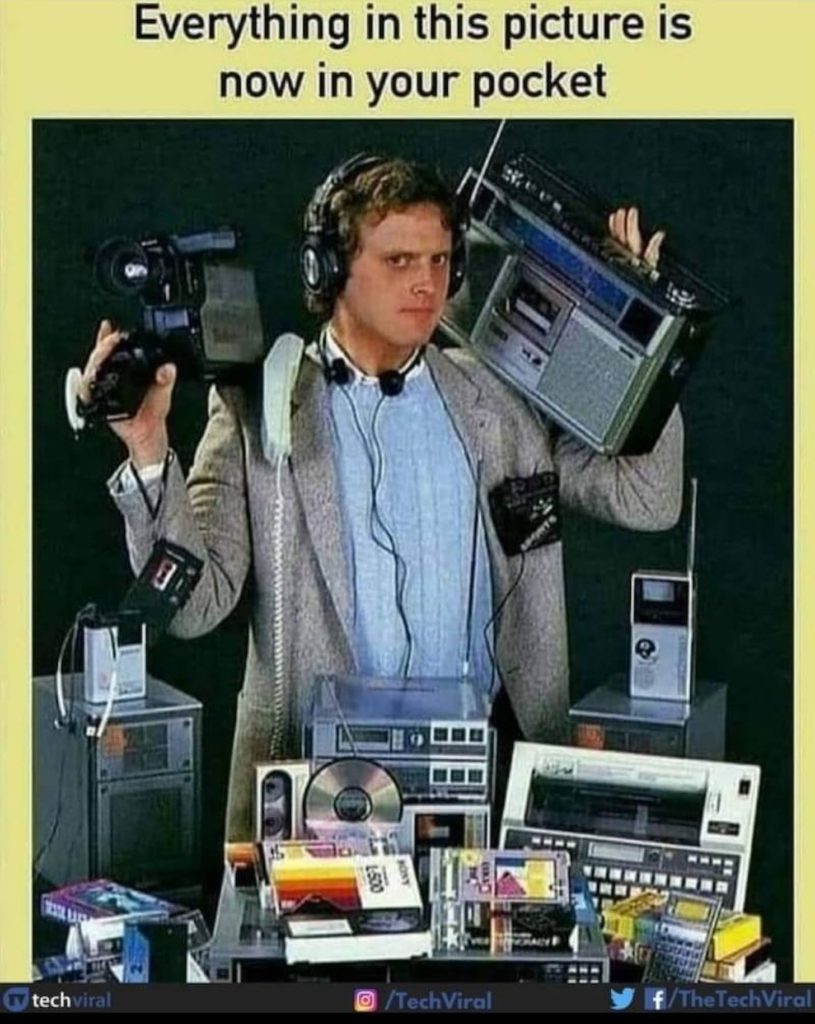

The challenge with blockchain systems such as Bitcoin was that they were built for a specific task. For example, a calculator can only perform the function it was built for. It can not be used as a video recorder. Traditionally we would build different device for each function. But Steve Jobs showed us that you can build one device that can allow various developers to make different apps and transform the functionality of that device.

In 2013, Vitalik Buterin proposed a similar idea of creating a generalized blockchain system that allowed developers to easily build specialized apps (DAPPS) on shared processing capacity of the etherum netowrk. Just like the Iphone & appstore enabled us to go from a specialized phone with not other functionality to an all in one device that is capable of many things (calendar, video, music, voice recorder.. the list goes on)

So what is Ether (ETH token) – it is the currency of the Ethereum blockchain and is used to transact on the etherum network & use the processing capacity

Ethereum is a favorite of program developers because of its potential applications with smart contracts that automatically execute when conditions are met and non-fungible tokens (NFTs).

Price Action: Ethereum has also experienced tremendous growth. In just five years, its price went from about $11 to over $2,500, increasingly roughly more than 22,000%.

3. Tether (USDT) – Mkt Cap $62Bn

Lets first understand 2 terms:

- Fiat Money is government backed currency that we use in our daily lives. Each country typically issues its own fiat currency and mandates it as legal tender.

- Stable Coin is a crypto equivalent of the designated fiat currency, where it is meant to mimic the price of the fiat currency & external reference it is pegged to. They are not subject to price volatility in the same way that traditional cryptocurrencies are. If it is the same then why do you need a stable coin? Well that is easy, because it gives you all the benefits of a crypto currency – fast & cheap to transfer, fractionalization etc.

So what is Tether (USDT)? it is a stable coin created by Tether Limited to track the USD. It’s backed by fiat currencies like U.S. dollars and the Euro and hypothetically keeps a value equal to one of those denominations. In theory, this means Tether’s value is supposed to be more consistent than other cryptocurrencies, and it’s favored by investors who are wary of the extreme volatility of other coins.

A crypto investor would view buying USDT as similar to holding cash. In volatile times it allows them to move to a safer asset and reduce chance of losses. However there is still counterparty risks as can be seen below.

USDT has been surrounded by controversy. In April 2019, New York Attorney General Letitia James accused iFinex Inc., the parent company of Tether Ltd. and operator of cryptocurrency exchange Bitfinex, of hiding a loss of $850 million dollars of co-mingled client and corporate funds from investors. Court filings say these funds were given to a Panamanian entity called Crypto Capital Corp. without a contract or agreement, to handle customers-withdrawal requests. Bitfinex allegedly took at least $700 million from Tether’s cash reserves to hide the gap after the money went missing1. In May 2021, Tether broke down the reserves for its stablecoin. The firm revealed that only a fraction of its holdings — 2.9%, to be exact — were in cash, while the vast majority was in commercial paper, a form of unsecured, short-term debt.2

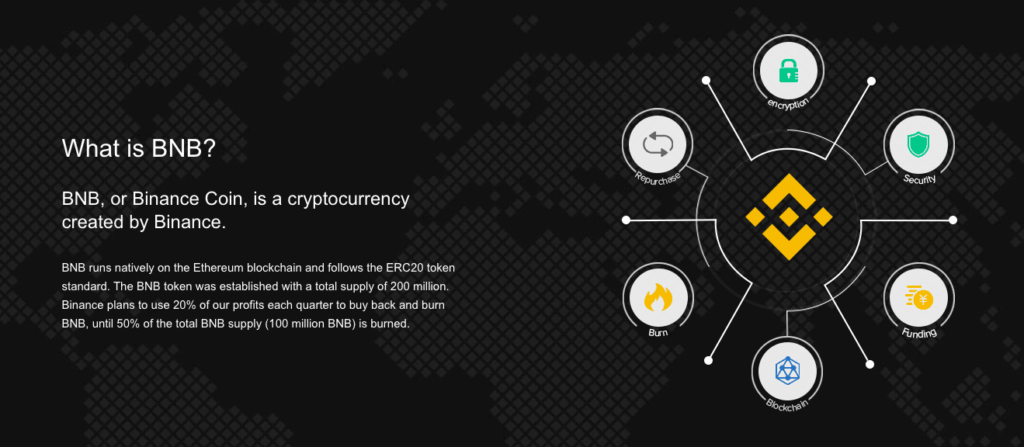

4. Binance Coin (BNB) – Mkt Cap $54Bn

Binance has seen its fair share of press & regulatory coverage most of this year.

It has aggressively grown beyond merely being one of the largest crypto exchanges in the world. The Binance Coin is a form of cryptocurrency that you can use to trade and pay fees on Binance. Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing, or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or Bitcoin.

Binance also has a Blockchain network that has been modified from the Ethereum base chain. Binance Smart Chain aims to lower transaction costs and provide a space to create DApps and other Defi products. BSC runs in parallel with Binance’s native Binance Chain (BC), which allows users to get the best of both worlds: the high transaction capacity of BC and the smart contract functionality of BSC.

Price Action: Its price in 2017 was just $0.10; by June 2021, it had risen to over $320, a gain of almost 320,000%.

5. Cardano (ADA) – $41Bn

Somewhat late to the crypto scene, Cardano is similar to Ethereum. It is a generalized blockchain platform that will allow others to build distributed apps on it. It is notable for its early embrace of proof-of-stake validation (uses a lot less electricity). This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification present in platforms like Bitcoin. Cardano also works like Ethereum with support added for smart contracts and decentralized applications, which are powered by ADA, its native coin.

Price Action: Cardano’s ADA token has had relatively modest growth compared to other major crypto coins. In 2017, ADA’s price was $0.02. As of June 2021, its price was at $1.30. This is an increase of 6,500%.

Doge – $27Bn (Honorable mention)

I know! I know! There are lots of views on Doge – the good, the bad & the ugly. However, one thing is given, when something manages to have a market capt of $27Bn it does deserve to be mentioned.

I plan to write a separate article to explore its fascinating history & community adoption

Some of my earlier posts if you have not read them yet

- 💸5 Essentials for CryptoCurrencies. Get started NOW!!

- 🚀A new era of Central Bank Digital Currencies

- Bitcoin Price – Scam or Real?

- 10 Investing Lessons I Learned

- 12 things I learned from Building Digital Ventures

If you liked this article – Do sign-up for my FREE weekly newsletter, share it with your friends, and give me feedback. You can find me on Social Media Twitter – @sauravbhats or Linked in.