Once you get hooked to investing, you are always looking for the perfect wave to ride – the right stock, at the right entry price, exiting at the perfect time!

Big Disclaimer: Let me start this article with the standard disclaimer. This is not investment advice. I am not an investment advisor. This information is meant to be for educational purposes. Please do your own research before you decide to invest your hard-earned money. If you are unsure seek help from a professional financial advisor who can understand the full breadth of your financial needs & commitments to advise you on what you should do.

Now that we have that behind us. Let’s get started

If you haven’t read the first part of this article from last week, I would suggest you start with that first.

A quick recap of what we covered so far:

- Investing should not be treated as a Hobby

- Learn to manage your FOMO(Fear of Missing out)

- Know your Risk Appetite – It hurts when it is real

- Important to book your gains

- Even Experts can’t predict what will happen next – Do your own Research

Lastly: Only when you combine the ‘Knowledge’ you gather with ‘Execution Experience’ do you get ‘Wisdom’.

So what else did I learn from my journey?

6. Cut your losses early & preserve your capital

No matter what anyone tells you. There is no such thing as a sure-win Investment.

Never let a loss exceed 7 to 10%. Set some hard rules around. Preserving your capital is the most important thing you can do. You have worked hard to earn it and must do everything to protect it. Some of the best traders & investors, don’t invest based on what they can make if things go well but rather based on what they are willing to lose if things go against them.

Never let a loss exceed 7 to 10%.

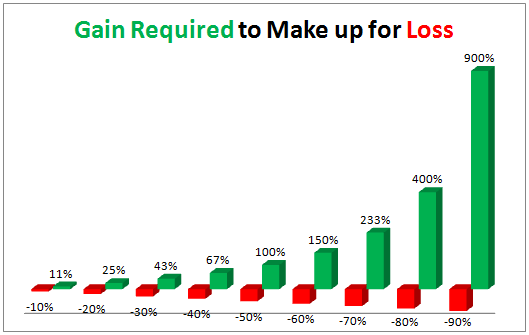

If you are down 70% in your portfolio, you need to see a 233% increase to make up for your losses.

As hard as it feels, be prepared to accept a measured loss if things are not going your way. This can easily be done in most trading platforms by setting a stop-loss (sell order when the price falls below a certain level). Understand what the 7-10% loss means in $ terms, and if it’s too big, reduce the size of the investment to a more acceptable level. And set the Stop-Loss order in the system as soon as you make the purchase when there are no emotions attached.

For those that work in financial institutions that restrict your ability to sell within a defined time period (30-days) or prohibit setting a stop loss, this can be a serious limitation. This further emphasizes the need to get better at “when to buy” (covered in the next point)

Enjoying this ?

Become a full subscriber to get full access

7. “When to buy” is as important as “What to buy”

Many of us obsess about finding the perfect stock, with the right financials, management team, execution, earnings etc.

The price for the stock does not hold still, it goes up or down for now understandable reason.

The price of a stock is really what someone in the market is willing to pay for it. This is influenced by many factors beyond your control.

When the Market is exuberant, a rising tide will lift all boats. More and more investors are looking for the same few stocks, quickly driving up the price. FOMO kicks in and you buy for all the good news & future earnings promise of the stock. But when the market exuberance wanes, the same star stock has very few takers and you see this shining beauty fall down from $40 to $10. Who has the answers to what happened??

Even long-term winners see huge declines in the short term(Amazon, Netflix, Tesla). Once you have done your research on the long-term winner you are looking to invest in, here are few practical tips to help you avoid those mistakes.

- Don’t put all your money into the investment at once – Ease into it gradually over months (not days, yes I have done it over days & regretted it)

- Dollar-cost average – Pick an amount you want to invest on a regular frequency – weekly or monthly and buy these investments as the price goes up or down. This helps you avoid the need to try to time the market

- Buying on Red days – This is really hard. Keep spare investable cash to buy when you see market-wide drops of 25-40%. These typically impact all stock and do not signal an issue in a particular asset. Does it mean the market can’t go down further? Of course not. But if you have done your research and still have the conviction that this is a long-term buy, you now have an opportunity to buy at a discount

8. Let your winners run (and cut your losses early)

Most investors attributed >80-90% of their profits coming from a handful of big winners (top performers). These not only paid for the small losses they incurred across their losers but gave big portfolio returns. Thus it is important to let your winners run and not get out of them too early.

If you sell Netflix in its second year or Amazon in its third year, and you didn’t get to enjoy the returns in the 10th and 15th years, you left almost untold amounts of money on the table. You lose far more when what could have been a 150-bagger — 150X your money held over 10 years — when you sell that out for a three-bagger because somebody told you to buy low, sell high.

The example below, of buying Tesla at $10 in 2013 to sell at around $45 in 2015. Yes, you got a 4X increase. But holding it for 6 more years would have seen it go from $45 to $850. an 85X increase.

The amount of money you leave on the table in those situations far exceeds losing 100% in a whole bunch of other positions. Again, just do the math.

9. Diversification is important but don’t overdo it!

Imagine you did all your research and invested all the money you had in 1 stock. A few months in the rockstar CEO is jailed for insider trading and the stock plummets 90%. It can happen but could you have avoided it. Of course!

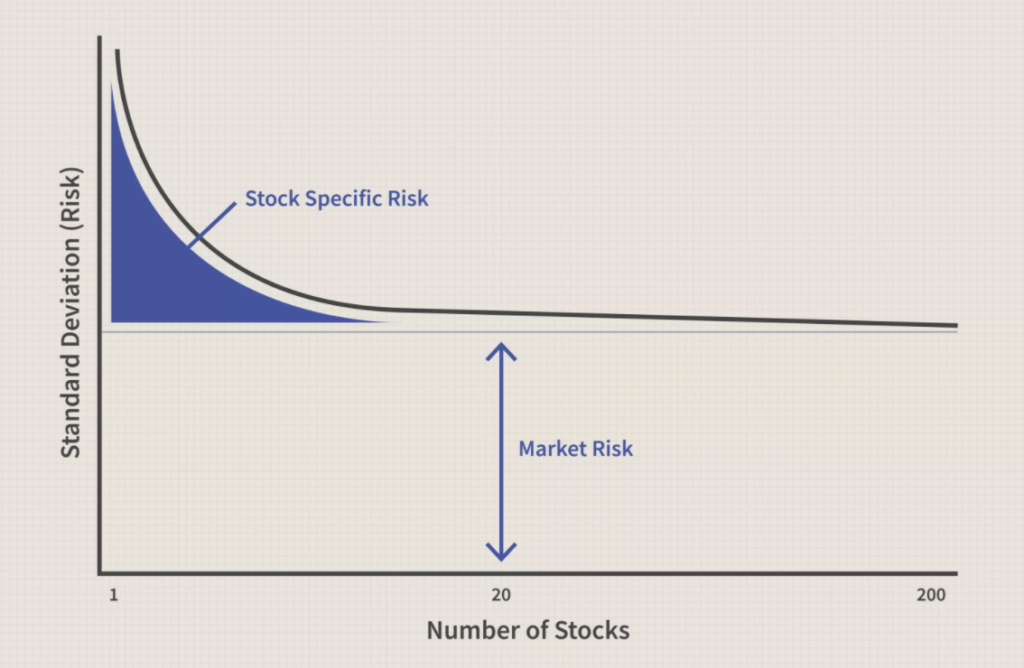

Diversification look to smooth out certain types of risk in a portfolio, so the positive performance of some investments neutralizes the negative performance of others. This can reduce the risk associated with individual stocks (what academics call unsystematic risk), but there are inherent market risks (systematic risk) that affect nearly every stock. No amount of diversification can prevent that.

Look to create a diversified portfolio across various types of assets (types of stock, bonds, real estate, markets, etc).

Ideally 15-25 investments can achieve diversification. Dont go overboard with 90-100 investments!

However, this is a fine balance! Too much of something isn’t good too. Don’t go overboard buying 90-100 investments (yeah, I have tried that too – don’t ask why). It is like trying to run your own ETF without any tools. It unruly to manage and eventually the gains you see in some of the stocks are so small they don’t really move your portfolio much.

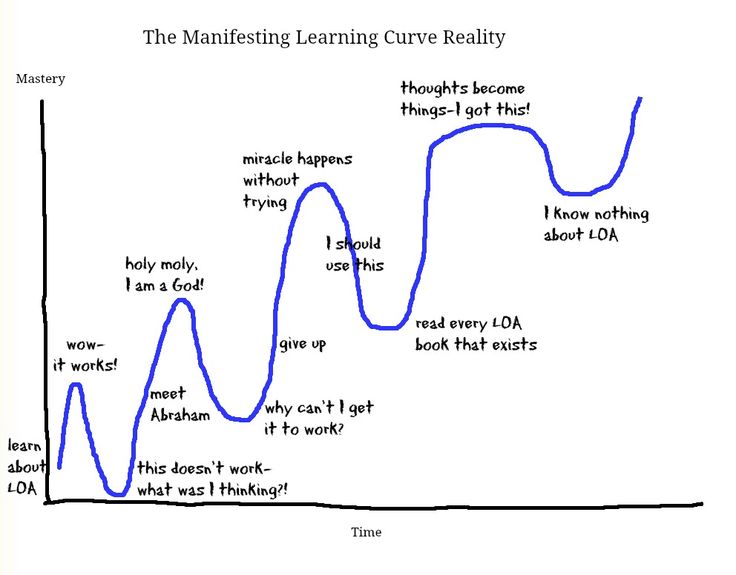

10. Like everything thing in life there is a learning curve

When I was younger I saw these cool Ninja movies and wanted to be a Ninja. I got my parents to buy me some of the gear from a toyshop and played around (not practiced) in make-belief fighting. I am definitely NOT a Ninja today.

Don’t expect to become an overnight success. You will go through phases of Euphoria and phases of total despair, I have learned more from my failures than from my successes. Treat each interaction as a learning experience where you are building a repeatable process to grow your investments and create long term success.

In Conclusion

This is not investment advice. These are some lessons I have learned (the hard way) along my journey that I wanted to share with others who may be interested. If you are not financially savvy, it is definitely a good idea to get professional financial advice. Don’t trade with money, you can’t afford to lose or put away for a period of time.

Like any new skill, it takes time to acquire but if you are patient & persistent it can be rewarding. Stay humble, continue to learn, and implement this knowledge in practice to improve.